The exercise of stock options, for instance, shows up as both a buy and a sell on Form 4 documents, so it is a dubious signal to follow. Forex trading indicators are tools that traders use to analyze market trends and predict future price movements. These indicators use mathematical calculations and statistical analysis to provide traders with important information about market trends and momentum. There are many different types of forex trading indicators available, each with their own unique benefits and drawbacks.

- Because they control such a large portion of all U.S. financial assets, institutional investors have considerable influence over the markets for most asset classes, and over time, this influence has only grown larger.

- Insiders tend to buy because they have positive expectations, but they may sell for reasons independent of their expectations for the company.

- So they generally do consider buying larger companies that are included in the relevant benchmark index.

- Each book gives you an informative insight into the concepts that are integral for the financial market traders and hence, institutional traders can also benefit from the same to apply the methods for their clientele.

- If something goes wrong with a company and all its big owners sell en masse, the stock’s value will plunge.

All traders learn to actively listen to their clients, focusing on understanding client expectations while developing the optimal trading strategy for each respective client. We can then respond with the expertise necessary to manage our clients’ trades most effectively. Our passion is client execution, which translates to getting the best price on each order for each client. These trading firms have access to vast amounts of capital and sophisticated trading tools that allow them to move markets with their trades. Institutional trading refers to large-scale trades made by banks, hedge funds, and other financial institutions.

Investment in exotic financial instruments such as swaps, forwards etc.

Institutional trading forex involves the use of advanced trading strategies and sophisticated financial instruments such as derivatives and currency options. These institutions have access to vast amounts of capital and employ teams of experienced traders and analysts who use fundamental and technical analysis to make informed trading decisions. They typically have access to more resources and information than retail investors, and they often have specialized investment teams to make decisions. Retail traders, often referred to as individual traders, buy or sell securities for personal accounts. Institutional traders buy and sell securities for accounts they manage for a group or institution. Pension funds, mutual fund families, insurance companies, and exchange traded funds (ETFs) are common institutional traders.

Local Firms Dominate Trading and Execution in Latin America – Institutional Investor

Local Firms Dominate Trading and Execution in Latin America.

Posted: Tue, 11 Jul 2023 12:13:16 GMT [source]

To achieve success in institutional trading, it’s essential to develop a solid understanding of the markets you’re operating in and stay up-to-date with industry trends. Institutional traders also hold a significant influence on the price dynamics of the market. Examples of institutional trading include algorithmic trading, high-frequency trading (HFT), and block trading. For example, if a large institution suddenly sells off a significant portion of its holdings in a particular security, it could trigger panic selling among other investors and cause prices to plummet. There are quite a few differences between the institutional investor and the retail investor, some of which have been pointed out previously. Below, you’ll find a summary of key differences that underscores the essential aspects of size and influence belonging to each type of investor.

Forex 4 and Technical Analysis: How to Use Charts and Indicators for Better Trading

They have the ability to invest in securities that generally are not available to retail traders, such as forwards and swaps, as well as IPOs. Institutional investors have an outsized influence over markets, and they own over 75% of the market value of the broadest equity index and account for 90% of the daily trading volume on that index. Furthermore, because they deal in large volumes and with special contracts, institutional traders have access to superior market prices and can even directly affect the price movement of the assets they trade. Indeed, big traders compete with one another to gain control of the market and steer it in their favor.

- Institutional investors make money either by charging their clients a flat fee or else by charging fees based on the value of the assets being managed.

- Critics of the dual-class share structure contend that, should managers yield less than satisfactory results, they are less likely to be replaced because they possess 10 times the voting power of normal shareholders.

- The New York Stock Exchange is one of the most well-known exchanges in the world, and it is where many institutional traders conduct their business.

- The knowledge from EPAT programme can be helpful in becoming an institutional trader.

Nevertheless if an individual is driven about becoming an institutional trader and is prepared to face the challenges one can do wonders in this job role. Using different factors, investors can generate higher returns, reduce risks and increase the diversification https://topforexnews.org/brokers/global-prime-alternatives-for-2021/ of the portfolio. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. The largest private asset manager is BlackRock, which holds about $10 trillion in assets under management as of 2022.

Introduction to Institutional Investing

They often hold significant ownership stakes in companies, making them majority owners in some cases, which gives them the power to influence important decisions such as mergers and acquisitions. This allows other investors to enter or exit positions more easily, which contributes to a more efficient market. The largest foundation in the United States is the Bill and Melinda Gates Foundation, which held https://currency-trading.org/cryptocurrencies/neo-lithium-stock-forecast-2025/ $55 billion in assets at the end of 2021. Foundations are usually created for the purpose of improving the quality of public services such as access to education funding, health care, and research grants. This course equips the individual with the necessary knowledge with regard to quantitative trading practices along with the knowledge and practical application of algorithmic trading concepts.

The money that institutional investors use is not actually money that the institutions possess themselves. Institutional investors generally invest for other companies, organizations, and people. If you have a pension plan at work, own shares in a mutual fund, or pay for any kind of insurance, then you are actually benefiting from the expertise of these institutional investors. Institutional trading is practised by a legal entity that accumulates funds from several different investors to invest in different financial instruments such as stocks, bonds, real estate etc.

Insider Ownership

This allows institutional traders to make quick decisions based on real-time market information. Whether you are a retail or institutional trader, it is important to stay informed about the latest trends and developments in the market to make informed decisions about your investments. https://forex-world.net/brokers/gt-io-south-africa-review-2021/ This is in stark contrast to retail traders who account for a much smaller percentage of daily trading volume. These institutions trade in large volumes and have access to advanced technology, research, and analysis tools that enable them to make informed investment decisions.

Successful institutional traders often use different approaches depending on their goals and risk tolerance levels. The New York Stock Exchange is one of the most well-known exchanges in the world, and it is where many institutional traders conduct their business. Retail and institutional traders have different approaches when it comes to trading. Institutional traders are also subject to stricter regulatory frameworks compared to retail traders due to their potential impact on market stability.

So, whether you’re a retail trader or an institutional trader, it’s important to understand the dynamics of institutional trading and how it impacts the financial market. Usually, when investing for the long term or trading for their own accounts, they invest much smaller amounts less frequently compared to institutional investors. Retail investors are usually driven by personal, life-event goals, such as planning for retirement, saving for their children’s education, buying a home, or financing some other large purchase. Institutional investors remain an important part of the investment world despite a flatshare of all financial assets over the last decade and still have a considerable impact on all markets and asset classes. Open-end funds have the majority of assets within this group, and have experienced rapid growth over the last few decades as investing in the equity market became more popular.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Institutional investors are companies or organizations that invest on behalf of their clients – usually other companies or organizations.

Institutional Forex Trading

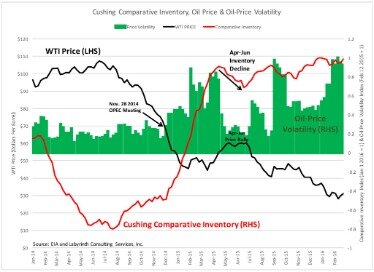

As a result, institutional trading can have a significant influence on the prices of assets. Forex trading is a complex and fast-paced industry that requires traders to stay on top of market changes and use the right tools to make informed trading decisions. One of the most important tools for institutional forex traders is technical indicators, which help traders analyze market trends and predict future movements. In this article, we’ll explore how institutional forex trading indicators work, the types of indicators available, how to use them to make better trading decisions, and the best strategies for successful trading.

LTX by Broadridge Integrates with BlackRock’s Aladdin – Traders Magazine

LTX by Broadridge Integrates with BlackRock’s Aladdin.

Posted: Thu, 13 Jul 2023 04:30:00 GMT [source]

In addition to Ethereum, other cryptocurrencies such as Solana, Cardano, and Polkadot also performed well in the ESG assessment. These platforms showcased excellent decentralization, which earned them top-tier A grades. However, it is Ethereum’s comprehensive approach to ESG considerations that distinguishes it from the competition. If you are like me, you may want to think about whether this company will grow or shrink.